arkansas estate tax return

4810 for Form 709 gift tax only. Arkansas estate tax return.

Tax Relief Available For Arkansas Illinois Kentucky And Tennessee Tornado Victims Kiplinger

However an Arkansas resident who has 13 million worth of estate cannot just gift away 940000 at once and forget about it.

. The current tax rate is between 35 percent and 55 percent for any amount above the exemption depending on how much you have so this can amount to a significant loss of. Any income of such estate or trust is currently distributable. Box 1000 Little Rock Arkansas 72203-1000 Mail No.

IRS Form 1041 US. Mail Tax Due Returns to. AR1000NR Part Year or Non-Resident Individual Income Tax.

Arkansas Income Tax Calculator 2021 If you make 70000 a year living in the region of Arkansas USA you will be taxed 12387. In all instances of estates required to file a Federal Return with assets totally or in part in Arkansas an Arkansas Estat e Tax. The decedent and their estate are.

Little Rock AR 72203-3628 If you owe tax make your check or money order payable to Department of Finance and Administration. AR1000NOL Schedule of Net Operating Loss. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Be sure to write your Social Security Number and. Arkansas residents now have until july. Contact pros today for free.

The tax rate on capital gains will be one half of the rate of tax on other types of income of an entity subject to the PET. Your average tax rate is 1198 and your marginal tax rate is. A return for the estate or trust for which heshe acts provided any of the following apply.

State Income Tax PO. We dont make judgments or prescribe specific policies. Wwwataparkansasgov Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued.

If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL. Ad Find affordable top-rated local pros instantly. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

The tax is item 10 on the Arkansas Estate Tax Return Form. The federal estate tax exemption is 1118 million which increased when the new tax bill was signed in 2017. Box 2144 Little Rock Arkansas 72203-2144 Mail Refund Returns to.

Tax returns and on the Arkansas. 31 rows Florence KY 41042-2915. State Income Tax PO.

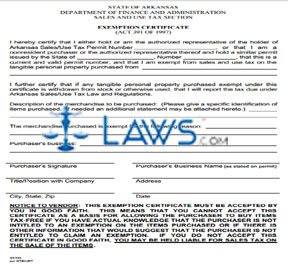

The Federal Gift Tax has an annual exemption. Arkansas Estate and Inheritance Tax Return Engagement Letter - 706 US Legal Forms offers access to the largest collection of fillable forms in Word and PDF format. See what makes us different.

On Arkansas income tax returns taxpayers must file following the rules in sections 167 168 179 and 179A under the Internal Revenue Code of 1986 enacted January 1 1999. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. AR1000F Full Year Resident Individual Income Tax Return.

If April 15 falls on a weekend or a holiday your return is due on the next business day. For tax years beginning in 2022 the tax rate for capital gains will be. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Check your refund status at. Department of the Treasury.

Effective tax year 2011 the. The due date for filing your Arkansas Individual Income Tax return is April 15.

How Long Does It Take To Get A Tax Clearance Letter Sexton Bailey Attorneys Pa

Arkansas Et 1 Form Fill Online Printable Fillable Blank Pdffiller

2020 2022 Form Ar Dfa Ar1000f Fill Online Printable Fillable Blank Pdffiller

Arkansas State Tax Information Support

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Arkansas Gift Tax How To Legally Avoid

Free Arkansas Tax Power Of Attorney Form Pdf Eforms

Arkansas Estate Tax Everything You Need To Know Smartasset

Form Ar1000nr Download Fillable Pdf Or Fill Online Arkansas Individual Income Tax Return Nonresident And Part Year Resident 2017 Arkansas Templateroller

Arkansas Excise Tax Return Et 1 Form 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Free From Arkansas Sales Tax Exemption Free Legal Forms Laws Com

Arkansas Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Arkansas

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Arkansas Inheritance Laws What You Should Know